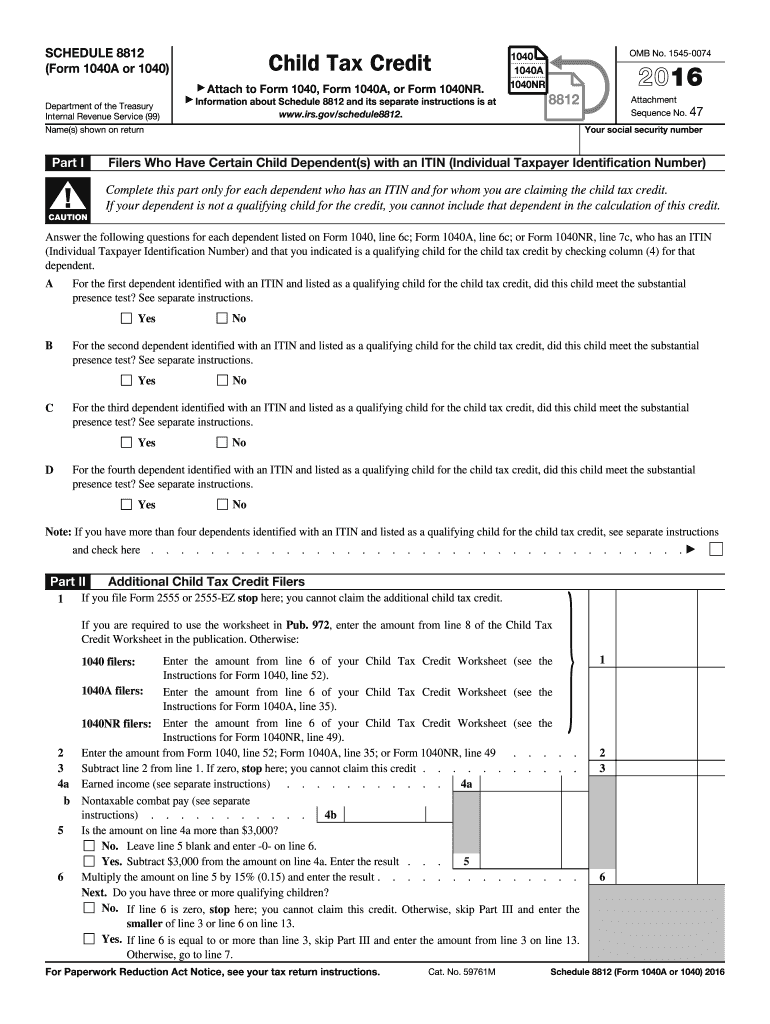

Form 8812 For 2016

To be a qualifying child for the child tax credit the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under qualifying child also see taxpayer identification number needed by due date of return earlier.

Form 8812 for 2016. If married filing jointly include your spouse s. How to fill out a 2016 schedule 8812 form. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico. And for whom you also checked the box in column 4 of that line is a resident of the united states because the child meets the substantial presence test and is not otherwise treated as a nonresident alien.

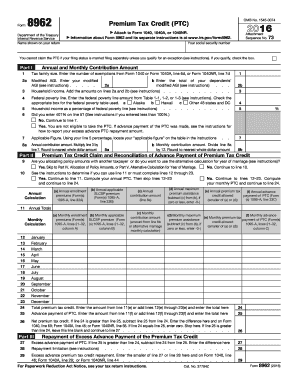

On the website containing the form choose start now and go for the editor. Schedule 8812 form 1040a or 1040 2016. Schedule 8812 form 1040a or 1040 2016 complete this part only for each dependent who has an itin and for whom you are claiming the child tax credit. Form 1040a line 6c.

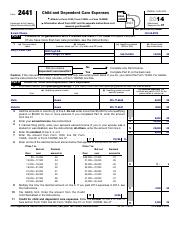

Form 1040a line 6c. 2016 form 1040 schedule 8812 child tax credit 2015 inst 1040 schedule 8812 instructions for schedule 8812 form 1040a or 1040 child tax credit 2015 form 1040 schedule 8812 child tax credit 2014 inst 1040 schedule 8812 instructions for child tax credit. Schedule 8812 form 1040a or 1040 2016. Withheld social security medicare and additional medicare taxes from form s w 2 boxes 4 and 6.

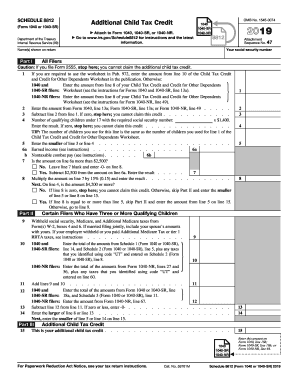

Instructions for schedule 8812 form 1040 a or 1040 child tax credit related forms form 1040 ss u s. Future developments for the latest information about develop. Irs schedule 8812 is the section on form 1040 that needs to be filled out to claim the federal additional child tax credit the additional child tax credit is considered a refundable credit which means that it entitles qualifying taxpayers to claim a refunded amount of the child tax credit if it exceeds their tax liability after factoring in the child tax credit. 2016 instructions for schedule 8812child tax credit use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040 line 6c.

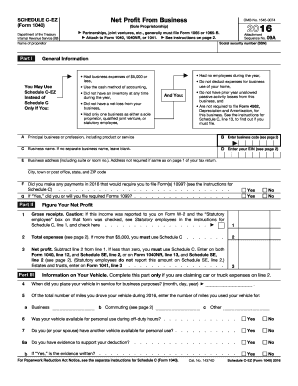

Section references are to the internal revenue code unless otherwise noted. Look through the quick manual to be able to complete irs 2017 form 8812 stay away from mistakes and furnish it in a timely way. Or form 1040nr line 7c. Use schedule 8812 form 1040 or 1040 sr to figure the additional child tax credit actc.

Or form 1040nr line 7c. If your dependent is not a qualifying child for the credit you cannot include that dependent in the calculation of this credit. Include your personal details and contact details. Use the clues to fill out the suitable fields.

And for whom you also checked the box in column 4 of that line is a resident of the united states because the child meets the.