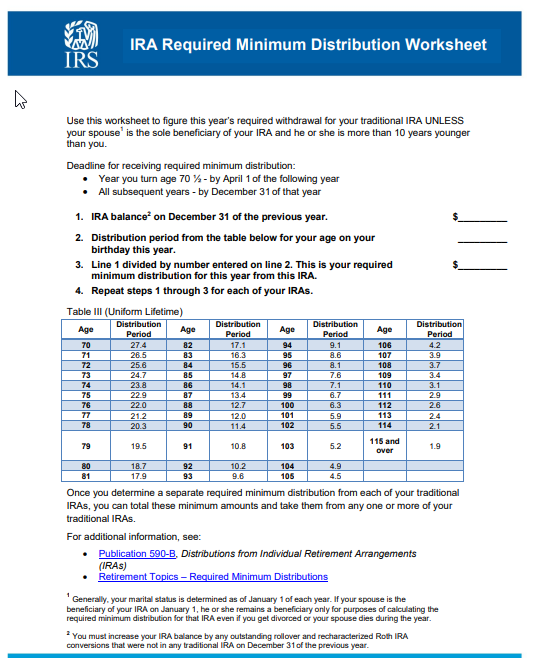

Ira Required Minimum Distribution Worksheet

Ira required minimum distribution worksheet author.

Ira required minimum distribution worksheet. To use the worksheet you will divide the balance from step 2 above by a number that you get from one of two required minimum distribution tables. This calculator assumes that if you are married your spouse is less than 10 years younger that you. Internal revenue service subject. Ira required minimum distributions keywords.

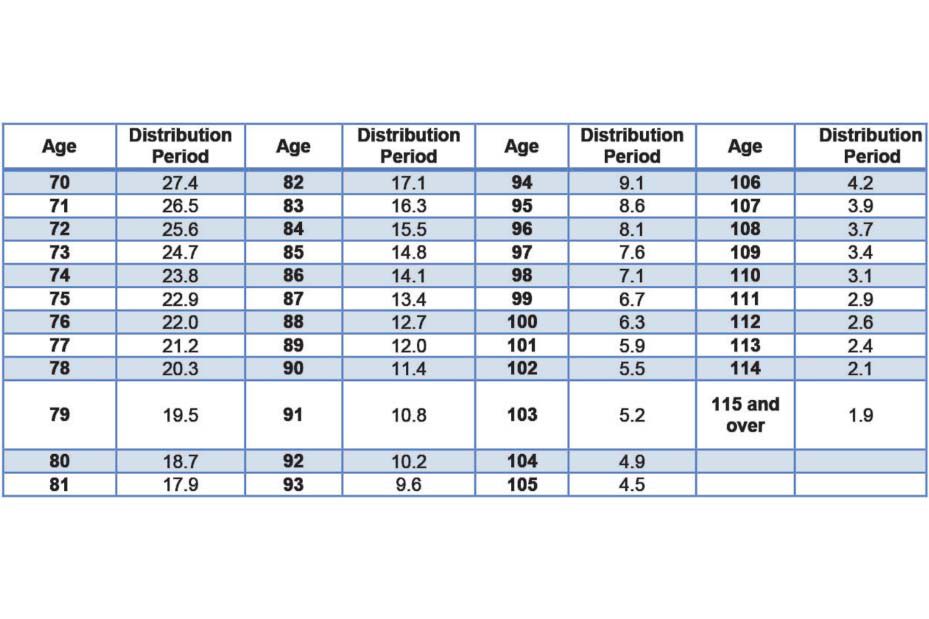

There is a required minimum distribution table for each of these 2 possible situations for an ira. Joe retiree who is 80 a widower and whose ira was worth 100 000 at the end of last year would use the uniform lifetime table. List each tax deferred retirement account and the balance on december 31 last year. Finra has a required minimum distribution calculator that you can use to figure out how much your rmd will be.

In general rmds must be taken separately for each of your accounts however if you have multiple 403 b. Divide each balance by your life expectancy divisor see the table on the following page. These tables are also in the appendix of publication 590 b. Deadline for receiving rmds.

Ira required minimum distribution worksheet use this worksheet to figure this year s required withdrawal for your traditional ira unless your spouse1 is the sole beneficiary of your ira and he or she is more than 10 years younger than you. Your rmd worksheet 2 how to calculate your rmds step 1. Deadline for receiving required minimum distribution. Year you turn age 70 by april 1of the following year.

This tax worksheet computes the required minimum distribution rmd a beneficiary must withdrawal from an inherited ira. If your spouse is more than 10 years younger than you then you must use a different. Ira required minimum distribution worksheet if your spouse1 is the sole beneficiary of your ira and he or she is more than 10 years younger than you use this worksheet to calculate this year s required withdrawal for your traditional ira. Use the worksheet irs provides there.

Do not use this worksheet for a surviving spouse who elects to treat an inherited ira as his her own or rolls the inherited ira over into his her own ira. Ira required minimum distribution worksheet use this worksheet to figure this year s rmd for your traditional ira unless your spouse 1 is the sole beneficiary of your ira and he or she is more than 10 years younger than you.