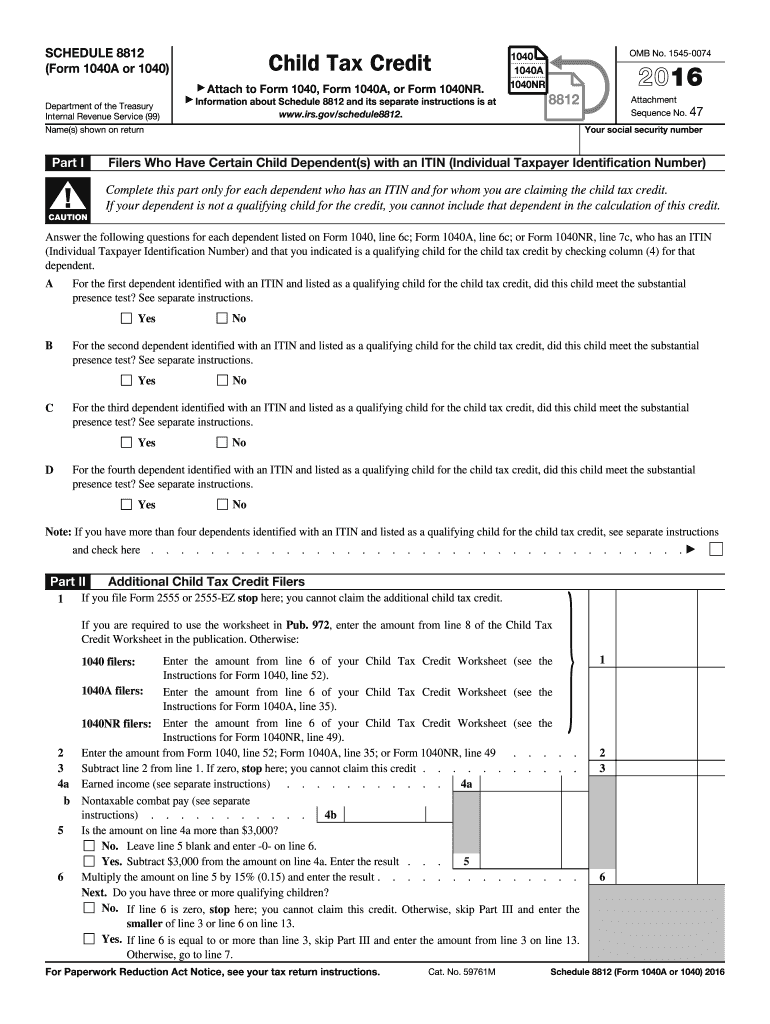

Schedule 8812 For 2016

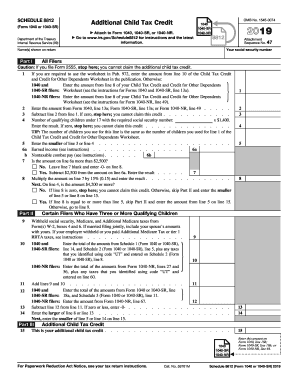

The additional child tax credit may give you a refund even if you do not owe any tax.

Schedule 8812 for 2016. The schedule 8812 form is found on form 1040 and it s used to calculate the alternative refundable credit known as the additional child tax credit. Schedule 8812 form 1040a or 1040 2016. The actc may give you a refund even if you do not owe any tax. Must be removed before printing.

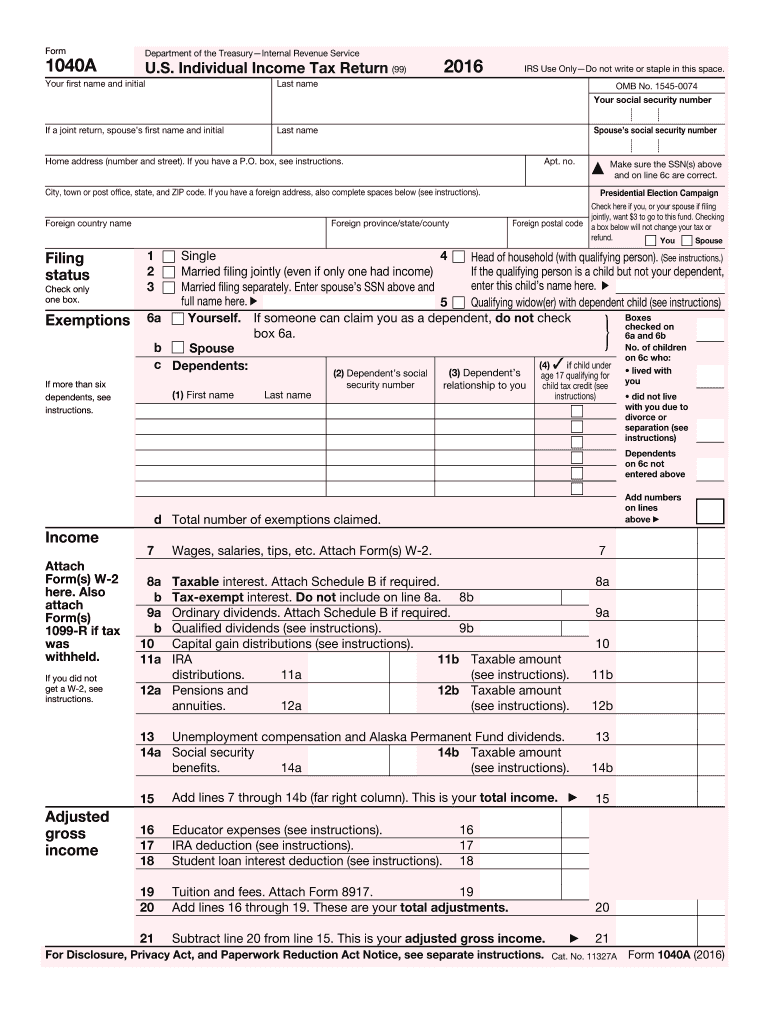

Schedule 8812 form 1040a or 1040 2016 complete this part only for each dependent who has an itin and for whom you are claiming the child tax credit. Use schedule 8812 form 1040 to figure the additional child tax credit. Information about schedule 8812 form 1040 additional child tax credit including recent updates related forms and instructions on how to file. Withheld social security medicare and additional medicare taxes from form s w 2 boxes 4 and 6.

If married filing jointly include your spouse s. Additional child tax credit keywords. Department of the treasury internal revenue service 2016 instructions for schedule 8812child tax credit use part i of schedule 8812 to document that any child for whom you entered an itin on form. Section references are to the internal revenue code unless otherwise noted.

Use schedule 8812 form 1040 or 1040 sr to figure the additional child tax credit actc. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico. 2018 schedule 8812 form 1040 author. 2016 form 1040 schedule 8812 child tax credit 2015 inst 1040 schedule 8812 instructions for schedule 8812 form 1040a or 1040 child tax credit 2015 form 1040 schedule 8812 child tax credit 2014 inst 1040 schedule 8812 instructions for child tax credit 2014 form 1040 schedule 8812 child tax credit.

For example if the amount you owe in taxesis either zero or less than the credit you cannot claim the full child tax credit of 2 000. Form 1040 a schedule 8812 child tax credit. Instructions for schedule 8812 form 1040 a or 1040 child tax credit. If your dependent is not a qualifying child for the credit you cannot include that dependent in the calculation of this credit.

Page 1 of 4 8 53 25 oct 2016 the type and rule above prints on all proofs including departmental reproduction proofs.